I.INTRODUCTION AND LITERATURE REVIEW

Green finance refers to economic activities that support environmental improvement, climate change response, and efficient use of resources, namely financial services for project investment, financing, project operation, and risk management in the fields of environmental protection, energy conservation, clean energy, green transportation, and green buildings. The development level of green finance has become an important driving force for the ecologicalization of a city’s industrial structure. Therefore, adhering and accelerating the development of green finance have become an important long-term strategic goal of a city. As the core of economic system, industry not only affects the utilization degree and benefit level of production factors in the economic system but also affects the direction of economic operation. The ecological industrial structure is the evolution from traditional polluting industry to green industry; therefore, it is the main task for a city to speed up the adjustment and optimization of industrial structure and energy structure. Green finance promotes the evolution of ecological industrial structure and plays an important role in promoting the development of ecological industrial structure by restraining the capital investment of traditional industry and providing capital investment for environmental protection enterprises. At the same time, this paper makes a quantitative classification of the development level of urban green finance and the difference of the impact of green finance development on the ecological industrial structure of each city, and the paper also puts forward suggestions on the adjustment and optimization of relevant policies, which has important practical significance to promote the process of ecological industrial structure of various cities.

Existing studies on the relationship between green finance and the ecologicalization of industrial structure initially focused on the relationship between the development of the financial industry and the industrial structure. Hellman et al. [1] and other studies found that the effective implementation of financial policies can promote the use of social funds in various industries. Free flow of social funds between them provides financial guarantee for the development of the industry [1]. Reed pointed out that the development of finance can promote the adjustment of industrial structure [2]. According to the research of Pang, financial institutions can increase investment in emerging industries and reduce investment in sunset industries to achieve the purpose of optimizing resource allocation efficiency [3]. With the development of green finance, researchers began to focus on the relationship between green finance and industry structure. Through the study on actual cases, Ma proved that practicality of green credit policy can significantly promote the transformation of the industrial structure to ecological [4]. Li et al. and others emphasized that green finance not only starts from the market to guide the flow of funds among various industries but also promotes the transformation of economic structure from the perspective of resource and income distribution and incentive mechanism [5]. Salazar and Cowan analyzed green financial instruments such as green loans, green funds, and carbon dioxide emission trading rights and pointed out that green finance can guide the flow of funds to environmental protection enterprises and realize the ecological adjustment of industrial structure [6,7].

Most of the related literature focuses on theoretical analysis. However, some scholars have discussed the impact of green finance on the ecologicalization of industrial structure from the perspective of empirical analysis. Chen and Hu explored the impact mechanism of green finance on the ecologicalization of industrial structure through empirical research and further verified that green finance can guide the flow of funds to realize the ecologicalization of the industry [8]. Zhang et al. took Colombia as an empirical research object to explore the impact of green finance model on industrial structure and found that green finance in the country can promote the development of clean technology and clean energy and then promote the development of ecological industrial structure [9]. Long and Chen analyzed the correlation between green finance and industrial structure by constructing a grey correlation model and believed that green finance promotes the ecological transformation of China’s industrial structure by limiting the loan amount of high energy-consuming industries [10]. Liu and He analyzed the impact of green finance on the industrial structure of the central region through a fixed effect model. The study pointed out that green finance can limit the development of polluting enterprises, thereby promoting the ecological development of the industrial structure [11].

Up to now, most of the existing studies on the impact of green finance on the industrial structure ecologicalization used descriptive analysis, and they all used static panel models. Few studies used dynamic panel models to study the impact of green finance on the industrial structure ecologicalization. In addition, the impact of green finance on the ecologicalization of the industrial structure is a dynamic impact, and the adjustment of the industrial structure is cyclical. The ecological level of the industrial structure in the previous year often has an impact on the ecological level of the industrial structure in the next year, so the static panel cannot well reflect the hysteresis of influence [12]. For the reason that adding the lag term of the explained variable to the dynamic panel model can fully reflect this dynamic process and make up for the insufficiency of the static panel. At present, it is generally believed that Gaussian mixture model (GMM) is more efficient than two stage least square in estimation, and GMM can solve endogeneity problems better. Therefore, this paper adopts the proportion of the added value of the environmental protection industry in the added value of the polluting industry as the indicator of the ecologicalization of the industrial structure and discusses the impact of green finance on the ecologicalization of the industrial structure through the dynamic regression GMM.

The rest of the paper is organized as follows. Section II presents the theoretical hypotheses. Section III presents the model design and variable selection. Section IV presents the analysis of empirical results. Section V presents the robustness test. Section VI presents the conclusions and recommendations.

II.THEORETICAL HYPOTHESES

Green finance can guide the flow of funds from polluting enterprises to environmental protection enterprises, greatly reducing the financing cost of environmental protection enterprises, effectively promoting the improvement of the production and operation scale of environmental protection enterprises, and further promoting the sustainable development of environmental protection enterprises. With the influx of large amounts of funds into green environmental protection enterprises, for one thing, it can promote the green innovation of enterprises, for another, it can guide consumers to form a green consumption concept and promote the sustainable development of environmental protection enterprises, thus contributing to the improvement of the ecological level of industrial structure [13].

Green finance not only reduces the financing cost of environmental protection enterprises but also increases the financing cost of polluting enterprises. Thus, it limits the development of polluting enterprises and reduces the difficulty of ecologicalization of industrial structure to a certain extent through providing strong support.

Therefore, this paper puts forward theoretical hypothesis 1: Green finance has a significant role in promoting the ecologicalization of urban industrial structure.

At present, there exists a global imbalance in the implementation of green financial policies among regions and industries. There is obvious heterogeneity in the development of green finance due to the differences in ecological environment conditions and economic development goals. The present immature capital market causes the lack of a unified green financial circulation mechanism among regions, and the green funds for the green transformation of polluting enterprises have not been fully circulated in different regions, resulting in different impacts of green finance on the ecologicalization of industrial structure of various regions.

Consequently, this paper proposes theoretical hypothesis 2: There are obvious regional differences in the development level of green finance in the urban area, which will make its impact on the ecologicalization of the industrial structure in the relatively developed and underdeveloped areas of the present regional heterogeneity in urban areas.

III.MODEL DESIGN AND VARIABLE SELECTION

A.MODEL DESIGN

In order to explore the impact of green finance on the ecologicalization of industrial structure, this paper attempts to conduct quantitative analysis through the systematic GMM. With reference to relevant literature of Gao [14], the ecologicalization of industrial structure is selected as the explained variable and the development level of green finance as the core explanatory variable. Considering that only one explanatory variable will cause serious deviations in the empirical results, this paper uses the level of opening to the outside world, human capital, urbanization, investment, technological innovation, and marketization into the model as control variables [15]. Since the level of ecologicalization often affects the level of ecologicalization of industrial structure in the next year, and the development level of green finance in the current year will affect the industrial structure in the next year, the following dynamic panel regression model could be established:

In the model, variable refers to the ecologicalization level of the industrial structure. The core explanatory variable refers to the development level of green finance in cities. refers to the lagging item of the ecologicalization level of industrial structure. refers to the lagging item of green finance development level. The control variables in X include the levels of opening to the outside world, human capital, urbanization, investment, technological innovation, marketization, etc. , and refer to the region fixed effect, year fixed effect, and random error term, respectively.B.VARIABLE SELECTION

1)EXPLAINED VARIABLE

In some literature, the ecologicalization of industrial structure generally uses the ratio of the output value of the tertiary industry to GDP as a measurement index [12]. In the other studies, the method of constructing an index system for the measurement of the ecologicalization level of industrial structure is adopted [14]. Generally speaking, the adjustment of industrial structure includes three aspects: The first aspect is the adjustment of the relationship between industries. It mainly refers to the adjustment of the proportional relationship among the three major industries, which is the center of the entire industrial structure. The second aspect is the adjustment of the proportion of the industrial structure. It mainly refers to the adjustment of the composition ratio within an industry. The third aspect is the adjustment of the industrial structure sequence. It mainly refers to the adjustment of the development sequence and speed of various industries. This paper uses the research from Wei [16] and uses the ratio of the added value of environmental protection industry to the added value of polluting industry as the measure index of the ecologicalization of industrial structure (ISO).

2)CORE EXPLANATORY VARIABLES

The core explanatory variable refers to the green finance development level (GF). Referring to the development level of international green finance, this paper constructs the evaluation index system of green finance development level with the following construction process: the original data are homogenized after collecting and sorting the data. The green financial development level of each city is measured by entropy method and green development level (GF). The core explanatory variable is obtained through standardization. The index system is shown in Table I.

Table I Index system of green finance development level

| First-level indicator | Secondary indicators | Indicator definition |

|---|---|---|

| Green credit | Proportion of green credit | Total green credit of the five major banks in the city/total loans of the five major banks in the city |

| Proportion of interest expenses in high energy-consuming industries | Interest expenditure of six high energy-consuming industrial industries in the city/total interest expenditure of industrial industries in the city | |

| Green investment | Proportion of public expenditure on energy conversation and environmental protection | Financial expenditure on energy conversation and environmental protection industrial in the city/total financial expenditure of city |

| Proportion of investment in environment pollution control | Urban pollution control investment/city GDP |

3)CONTROL VARIABLES

Although there are many factors affecting the ecologicalization of the industrial structure, this paper selects the main control variables as follows to minimize the estimation bias. The first variable refers to the level of opening to the outside world (Fdiratio). Opening to the outside world can introduce advanced technologies, expand financing channels for enterprises, and promote technological innovation of enterprises and thus contribute to the ecological development of urban industrial structure. The second variable refers to the level of human capital (Edu), which is measured by the ratio of the number of students in ordinary institutions of higher learning in each city to the total population of the region in that year. The level of education is used to reflect the adjustment of industrial structure. The third variable refers to the level of marketization (Mopen), which is measured by the proportion of budget of government expenditure in cities to GDP. The higher the level of marketization, the better the economic development of the region and the vigorous enterprise vitality, which will promote the ecological development of the industrial structure. The fourth variable refers to the urbanization rate (UR), which is measured by the proportion of urban population to the total population in cities. The higher the urbanization rate, the greater the degree of reallocation of resources, contributing to the evolution of industrial structure to ecologicalization. The fifth variable refers to the investment in fixed assets (TZ), with the amount of fixed asset investment in natural logarithm. Fixed asset investment reflects the impact of local investment on the industrial structure. The increase in fixed asset investment can promote the improvement of production efficiency, thereby contributing to the ecological development of industrial structure. The sixth variable refers to green technology innovation (TIN), which is measured by the proportion of the number of authorized urban green patent applications to the number of patent applications [17]. The level of green technology innovation represents the production efficiency of environmental protection enterprises and is also an important factor affecting the ecologicalization of industrial structure. The description of the main control variables is shown in Table II.

Table II Description of the main control variables

| Variable name | Variable meaning |

|---|---|

| Level of opening to the outside world (Fdiratio) | Actual amount of foreign capital utilized in the city/the gross domestic product of city |

| Human capital level (Edu) | Annual number of students in ordinary colleges and universities in each region of city/the total population of city in that year |

| Marketization level (Mopen) | The city government’s fiscal expenditure/GDP of the city |

| The urbanization rate (UR) | Urban population by region/total population by region |

| Fixed asset investment (TZ) | Natural logarithm of the fixed asset investment amount |

| Green technology innovation (TIN) | Number of green patent applications granted/patent applications in the city |

4)DATASET AND SOURCES

Considering the availability and validity of data, we constructed a new balanced panel dataset from target cities over the period of 2012–2020 with a total of 153 samples. The data after 2020 are incomplete for statistical analysis due to the pandemic in most recent years. The original data come from Guotai’an Database, Wind Database, etc.

Descriptive statistics of all main variables of the sample are shown in Table III.

| Variable name | Variable meaning | Number of samples | Average value | Standard deviation | Min | Max |

|---|---|---|---|---|---|---|

| ISO | The level of ecological structure of the industrial structure | 153 | 0·4320 | 0·7100 | 0·2567 | 0·6179 |

| GF | The level of green finance development | 153 | 0·3474 | 0·0997 | 0·0506 | 0·5075 |

| Fdiratio | Urban FDI as a share of urban GDP | 153 | 0·0131 | 0·0140 | 0·0065 | 0·1106 |

| Edu | Level of human capital | 153 | 0·9116 | 0·2738 | 0·5106 | 1·998 |

| Mopen | Marketization level | 153 | 0·1198 | 0·0252 | 0·0694 | 0·2011 |

| BORN | Level of urbanization | 153 | 0·5889 | 0·1384 | 0·2161 | 0·9218 |

| Ln(tz) | Investment level of fixed assets (100 million yuan) | 153 | 2·6974 | 0·0558 | 2·5326 | 2·8233 |

| Believe | The level of technological innovation | 153 | 0·5791 | 0·1102 | 0·2569 | 0·9661 |

IV.ANALYSIS OF EMPIRICAL RESULTS

A.MACHINE LEARNING ANALYSIS

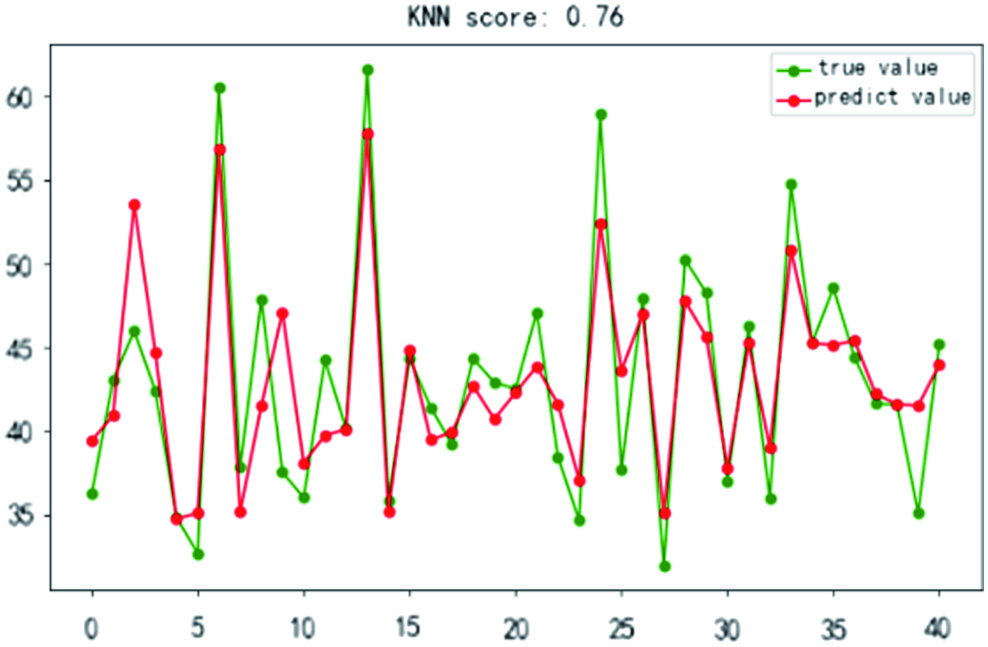

This paper applies machine learning models into our data analysis. It uses KNN and random forest prediction models, with70% of the data as the training set and 30% as the test set. As shown in Figures 1 and 2, the prediction results are based on KNN and random forest, respectively. In the figures, the actual values of the explained variable (ISO) are obtained through data collection, which is different from that predicted by the core explanatory variables and control variables. The accuracy rates of the predicted values of the variables (ISO) are 76% and 89%. However, most scholars lack research in this area, and further exploration is needed to determine whether the prediction results of machine learning are within a reasonable range. In this paper, more than 70% accuracy rate can be regarded as acceptable. Therefore, the variables selected by the model established in this paper are reasonable and can be further empirical analysis.

B.DYNAMIC PANEL MODEL ANALYSIS

This paper introduces the dynamic panel model to empirically analyze the impact of green finance on the ecologicalization of urban industrial structure. In order to solve the deviation and endogenous problems caused by the dynamic panel, this paper uses the systematic GMM for empirical analysis. The results of the system GMM are shown in Table IV. There is a strong correlation between the control variables and explained variables (each control variable is significant at the level of at least 10%), which further verifies that the prediction results of machine learning are accepted by us. In accordance with the characteristics of the dynamic panel, the endogenous variables selected in this paper are the one-period lag of the explained variables and the explanatory variables such as green finance, human capital, and marketization level. In order to increase the reliability of the regression results, the validity of the instrumental variables selected by the model was tested. The regression results are shown in Table IV. The difference of the random disturbance term has first-order autocorrelation rather than second-order autocorrelation; thus, the assumption of no autocorrelation is acceptable; the P values of Sargan are all greater than 0·5; thus, there is no overidentification in the regression results.

Table IV Regression results of the impact of green finance on the ecologicalization of urban industrial structure

| (1) | (2) | |

|---|---|---|

| ISO | ISO | |

| One period behind | 1·2598 | 1·4075 |

| (3·99) | (4·97) | |

| GF | 0·1065 | 0·8448 |

| (3·08) | (2·14) | |

| L.GF | 0·0256 | |

| (2·02) | ||

| FD | 0·0473 | −0·5080 |

| (1·69) | (−1·70) | |

| Edu | 0·0067 | 0·0770 |

| (1·83) | (1·58) | |

| Mopen | 0·5784 | 0·0412 |

| (1·74) | (2·81) | |

| UR | 0·0752 | 0·9706 |

| (2·42) | (18·16) | |

| Ln (tz) | 0·0134 | 0·0683 |

| (2·84) | (5·34) | |

| Tin | 0·0115 | 0·0348 |

| (2·98) | (3·63) | |

| C | −0·0082 | −0·2846 |

| (−0·27) | (−1·16) | |

| AR(1) | 0·0298 | 0·0126 |

| AR(2) | 0·7287 | 0·7887 |

| Sargan | 0·5514 | 0·6193 |

| Observations | 153 | 153 |

Note: The brackets in the table are t-value; *, **, and *** indicate significant at the level of 10%, 5%, and 1%, respectively.

In accordance with the results in Table IV, the lag phase of industrial structure ecologicalization is significantly positive at the level of 1%, indicating that the ecologicalization level of industrial structure in the previous phase has a significant positive impact on the ecologicalization level of industrial structure in the next phase, and the ecologicalization of industrial structure is consistent. The impact of green finance level on the ecologicalization of urban industrial structure is significantly positive at the significance level of 1%, indicating that green finance level has the significant positive and enhancing effect on the ecologicalization of urban industrial structure, which verifies hypothesis 1. From the regression results, the regression coefficients of green finance and its lagging term are 0·1065 and 0·0256, respectively, indicating that when the development level of green finance increases by 1%, it cannot drive the development of ecological industrial structure to the same extent. It is mainly due to the relatively low level of development of green finance in cities, insufficient support from financial institutions to green finance, and the insufficient understanding of green finance from all walks of life; green finance does not have enough support in the development process; thus, it cannot further promote the ecological industrial structure.

For the control variable, the level of opening to the outside world (FD) is significantly positive at the level of 10%, which indicates that the level of opening to the outside world can promote the ecological development of the urban industrial structure. The level of human capital (Edu) is significantly positive at 10%, indicating that human capital has a significant positive impact on the ecologicalization of urban industrial structure, which means that higher human capital is conducive to the ecologicalization of urban industrial structure. The marketization level (Mopen) is significantly positive at the level of 5%, indicating that higher marketization level will lead to greater market demand of each industry, and thus promoting the development of ecological industrial structure. The urbanization level (UR) is significantly positive at 5%, indicating that the improvement of urbanization level is conducive to the ecologicalization of industrial structure. Generally speaking, the higher fixed asset investment will lead to the improvement of enterprise production efficiency and then promote the ecological industrial structure. However, from the regression results, the level of fixed asset investment does not significantly affect the ecologicalization of regional industrial structure. The green technology innovation level (Tin) is significantly positive at the level of 1%, indicating that science and technology innovation has promoting effect on the ecological development of urban industrial structure.

C.SUBSAMPLE REGRESSION

The metropolitan area is large; thus, the scale of green finance development and industrial structure in various cities are different. Among them, the influencing factors that determine the ecologicalization of the industrial structure are also different. As a result, it is necessary to explore the impact of green finance on the ecological level of the industrial structure at the regional level. Based on geographical location and economic development level, the metro area is divided into two samples for regression: relatively developed economic area and relatively undeveloped economic area. The specific results are shown in Table V.

Table V Regression by sample: the impact of green finance on the ecologicalization of urban industrial structure

| (1) | (2) | |

|---|---|---|

| Economically developed areas | Economically underdeveloped areas | |

| ISO | ISO | |

| One period behind | 0·7246 | 0·6926 |

| (4·02) | (16·08) | |

| GF | 0·1292 | 0·0897 |

| (2·98) | (2·79) | |

| L.GF | 0·0382 | 0·0150 |

| (1·86) | (4·62) | |

| Control variable | Yes | Yes |

| AR(1) | 0·02 6 4 | 0·0164 |

| AR(2) | 0·7149 | 0·7434 |

| Sargan | 0·6128 | 0·5836 |

| Observations | 63 | 90 |

Note: The brackets in the table are t-value; *, **, and *** indicate significant at the level of 10%, 5%, and 1%, respectively.

Regardless of whether the metropolitan area is relatively developed or underdeveloped, there is a significant positive effect between green finance and the ecologicalization of industrial structure. Regardless of whether relatively developed or underdeveloped, green finance is significantly positive at the level of 5%, indicating that the level of green finance in both relatively developed and underdeveloped areas has a significant impact on the ecologicalization of the industrial structure. However, judging from the regression coefficient of green finance level, the effect of green finance on the ecologicalization of industrial structure in relatively developed areas is significantly higher than that in relatively underdeveloped areas. It is mainly due to relatively high development level of green finance in relatively developed areas, relatively abundant green financial products, and financial support for the green development of enterprises through diversified direct financing means such as green bonds and green funds, thus making the areas with relatively developed economy. The ecologicalization of industrial structure is more dependent on diversified green financial tools, so that the degree of ecologicalization of industrial structure in relatively developed areas is significantly higher than that in economically underdeveloped areas, which verifies hypothesis 2.

V.ROBUSTNESS TEST

Since it is difficult to replace the green finance level indicator, this paper removes the control variables such as the levels of opening to the outside world, technological innovation, and urbanization on the basis of the original model and then performs regression test. The regression results are shown in Table VI. The core explanatory variables and the first period of the lag are still obvious, indicating that the model is robust.

Table VI. Robustness test of dynamic panel data

| (1) | (2) | (3) | |

|---|---|---|---|

| ISO | ISO | ISO | |

| One period behind | 0·9221*** | 0·9044*** | 0·9312*** |

| (11·558) | (11·28) | (12·44) | |

| GF | 0·0865** | 0·1120** | 0·0765* |

| (3·94) | (2·83) | (2·20) | |

| L.GF | 0·0927* | 0·0938* | 0·0535* |

| (1·68) | (1·96) | (1·56) | |

| Control variable | Yes | Yes | Yes |

| AR(1) | 0·0082 | 0·0126 | 0·0056 |

| AR(2) | 0·6345 | 0·6612 | 0·6 53 8 |

| Sargan | 0·6779 | 0·6193 | 0·6 38 9 |

| Observations | 153 | 153 | 153 |

Note: The brackets in the table are t-value; *, **, and *** indicate significant at the level of 10%, 5%, and 1%, respectively.

VI.CONCLUSIONS AND RECOMMENDATIONS

A.RESEARCH CONCLUSION

Based on the panel data of each city from 2012 to 2020, this paper adopted systematic GMM to study the impact of green finance development level on the ecological industrial structure of cities. The results showed that at the level of city, green finance could significantly promote the ecological level of industrial structure at the level of 1%. At the regional level, the level of green finance in both relatively developed and underdeveloped regions was significantly positive at the level of 5%, indicating that the level of green finance in both relatively developed and underdeveloped regions played a significant role in promoting the ecologicalization of industrial structure. However, from the regression coefficient of green finance level, green finance played a significantly greater role in promoting ecologicalization of industrial structure in the economically developed areas than in the economically underdeveloped areas.

B.COUNTERMEASURES AND SUGGESTIONS

As green finance plays a significant role in promoting the ecologicalization of industrial structure, cities can advance the ecological industrial structure by improving the development level of green finance. First, enhancing green credit innovation. Meanwhile, enterprises should be encouraged to uphold green environmental protection concept in a bid to speed up green innovation among enterprises [18]. Second, supporting the large financial institutions for their comprehensive operations of green finance. Large financial institutions almost possess full relevant licenses for offering financial services including banking, insurance, securities, fund, trust, financial management, and investment. They have served as their basic conditions and professional ability to comprehensively develop diversified green financial products, such as green credit, green bond, green insurance, green fund, and green financial management, which can boost the innovation and upgrade of financial products. Third, there should be a reinforcement of the innovation of green financial derivatives, improvement of the green financial derivatives and green intermediary service market, etc.

Due to the difference in the impact of green finance development level on the ecological development of industrial structure among various cities, the governments of all regions can push forward the development of ecological industrial structure via improvement of the green finance market and other means. First, the regional green financial market should be coordinated to ensure unimpeded circulation of green funds among the regions. Second, the governments in economically relatively underdeveloped areas should increase support in green finance, so as to stimulate enterprises in green innovation. Third, the governments of the economically relatively undeveloped areas should issue corresponding policies to introduce foreign investment, vigorously foster environmental protection enterprises, strictly safeguard the bottom line of the environment, and develop cities toward the goal of environmental friendliness.

Green financial technology as an emerging technological field can give priority to the development of green finance so as to step up the ecological industrial structure. First, at the policy level, it is recommended that the governments at all levels and financial authorities issue green financial technology development plans and guiding documents and increase the investment in green financial technology infrastructure. Second, the financial supervision departments should use blockchain, big data, artificial intelligence, and other technologies to improve the efficiency of green financial business data submission and statistical analysis, to realize the traceability and antigreen washing of green assets, and to improve supervision capabilities, promoting the ecological development of industrial structure [19, 20].

It is recommended that financial institutions and green environmental protection enterprises formulate relevant plans for the development of green financial technology, increase resource investment in green financial technology, and improve green digital capabilities. First, financial institutions should improve the ability to discern the risks, with the help of big data, artificial intelligence, and other technologies to gain the ability of identifying and controlling green financial risks. Second, financial institutions should increase the investment in financial technology in the field of green financial innovation and utilize blockchain technology for establishing the underlying asset pool for green financial product bondage. Third, financial institutions should accelerate the training of green fintech-related talents and provide strong support in talents for the sustainable development of green fintech.