I.INTRODUCTION

A service outsourcing agreement is a contract between the parties. The inability to quantify the service provider’s input and the information asymmetry between the partners create moral and contractual risks in the service process [1–2], which hinder or even prevent service outsourcing from succeeding. These issues are present in the process of service outsourcing in numerous industries, including information technology [3], information security [4], and cloud computing [5].

Most studies on moral hazard and information asymmetry in service outsourcing involving customer enterprises are based on principal-agent theory, using incentives to address them, and they rarely involve research on the application of information technology. Hsieh et al. [6] argued that the customer enterprise involvement could improve value creation, service provider efficiency, and service outsourcing performance. Xu et al. [7] established an incentive mechanism for the environmental service supply chain under double information asymmetry based on principal-agent theory to solve the information asymmetry problem in the environmental service supply chain. Dai et al. [8] studied the design of sharing contracts under bilateral moral hazard with the participation of customer enterprises. Zhang [9] used the Stackelberg game model under the quality principal-agent theory to analyze the quality incentive contract Nash game equilibrium when moral hazard and adverse selection coexist in the logistics service supply chain under symmetric information conditions. Some scholars have also studied service outsourcing from the perspective of the supply chain, mainly from the perspective of incentives and coordination mechanisms, for example, from the perspective of linear compensation contract coordination [10], knowledge sharing coordination [11], knowledge collaboration [12], and revenue sharing contracts [13] to study supply chain profit distribution and coordination.

The literature mentioned above focuses primarily on passive incentives; blockchain technology makes it possible to switch from passive to active rewards and makes up for their shortcomings. The core components of blockchain, including a distributed ledger, asymmetric encryption, a consensus mechanism, and smart contracts, can efficiently link the data of upstream and downstream businesses in the supply chain to ensure the validity and dependability of transaction information [14] and efficiently address the moral risks of service providers [15]. The decentralized nature of blockchain can fully realize the bilateral sharing of information and solve the information asymmetry problem [16–18]. Li and Zhang [15] studied on the moral risk issue involving third-party logistics service providers and investigated the approach of implementing blockchain technology to prevent the moral risk of third-party logistics service providers as an example of recent research on blockchain applications. Li and Yi [17] made a mechanism for sharing information about pollution abatement in the supply chain that was powered by blockchain. They compared it to a mechanism for screening pollution information in the supply chain that was based on the principal-agent theory.

We summarize the aforementioned studies and identify the following problems: (1) the majority of the research mentioned above analyzed service provider risk appetite and service provider incentives in terms of service provider risk avoidance and service provider risk incentives [19]. In practice, however, customer companies also have risk appetites as principals. (2) The majority of the studies mentioned above made the assumption that the customer enterprise could present a take-it-or-leave-it contract for the service provider to choose, which is quite different from reality [20], and the results in the service provider only receiving reserved utility and not sharing the cooperation surplus. (3) While the nature of blockchain technology can effectively address these issues, little study has been done on leveraging it to prevent moral hazards and reward service providers.

In this study, a Stackelberg game model based on the principal-agent framework is developed under the assumption that the service provider is risk averse and the client firm exhibits features of absolute spending risk aversion. First, the Nash equilibrium of the dynamic game is analyzed, and the optimal solutions of several models are found and compared. Second, from the supply chain standpoint, this paper finds the Pareto ideal of service outsourcing and builds the coordination mechanism. Then, under the coordination mechanism, the service outsourcing process supervision architecture and the distributed incentive mechanism based on blockchain are designed to provide a solid theoretical foundation for designing the service outsourcing incentive mechanism with the participation of customer enterprises sharing their knowledge.

II.PROBLEM DESCRIPTION AND MODEL ASSUMPTIONS

Consider a secondary service supply chain consisting of a customer enterprise and a service provider. The customer enterprise outsources a specific business to the service provider, and the customer enterprise participates in the service outsourcing through a knowledge participation and revenue sharing contract. The service provider decides its service level according to the contract designed by the customer enterprise. Before the contract is signed, both parties make strategic choices based on their expectations. The customer enterprise designs the outsourcing contract based on the dynamic decision-making process between the two parties, with different incentives and participation constraints for service providers under different strategy combinations.

The following assumptions are made in this paper.

Hypothesis 1:The strategy set of service providers and customer enterprises in the game process is (provide true information, provide false information), (trust, distrust). Service providers can choose to provide or not to provide private information about their true capabilities and service levels, and customer enterprises can choose to trust or distrust them after knowing the service provider’s strategy.

Hypothesis 2:The output after executing a service outsourcing project is influenced by the service provider’s service level, the knowledge involvement of the customer enterprise, and other uncertainties. According to the Holmstrom and Milgrom parametric expansion model, the output function of the outsourced service is ,where is the service level of the service provider, that refers to the various services taken by the service provider to ensure the quality of service, is the parameter of the effect of service level on service output, and are other uncertain influences which satisfy . Thus, the expectation and variance of the output function are respectively:

.Hypothesis 3:The production cost of the service provider is influenced by its service level and the knowledge participation of the customer enterprise t. Assume that the cost function of the service provider is

where is the cost factor. The customer enterprise participation cost is , where x (x > 0) is the cost coefficient of knowledge participation.Hypothesis 4:The revenue sharing incentive payment contract given by the customer enterprise to the service provider is , where is the total payment from the customer enterprise to the service provider, R is the fixed expenditure received by the service provider before the outsourcing implementation, and () is the revenue sharing incentive factor.

Hypothesis 5:The customer enterprise has the characteristic of absolute expenditure risk aversion, which is described by the negative exponential utility, i.e., , where is the customer enterprise’s expenditure risk utility, and is the absolute expenditure risk aversion measure. Under the expenditure risk aversion characteristic of the customer enterprise, the equivalent expenditure utility is equal to the actual monetary expenditure , i.e., , and the expenditure risk cost of the customer enterprise can be obtained as .

Hypothesis 6:Assume that the retained earnings of the service provider’s participation in the constraint is under complete information. When the customer enterprise chooses “no trust,” it is willing to pay the maximum benefit service provider maximum benefit for , then participate in the constraint of retained earnings for , which need to meet . When the service provider chooses to “provide false information,” it will increase its retention earnings based on the actual retention earnings because the service provider can no longer comply with the participation constraint that the profit is equal to the actual retention earnings by its information advantage. Assuming that the larger the is, the higher the acceptable retained earnings of the customer enterprise, the increase in the retained earnings of the service provider is positively correlated with of the first order, i.e., , b(b > 0) is the sensitivity coefficient of the revenue sharing incentive. At this point, the retained earnings of the participation constraint is .

III.MODEL ANALYSIS

The process of service outsourcing can be divided into two stages. In the first stage, the dynamic game between the two parties before the contract is signed, where different decisions will lead to different information scenarios in the dynamic game. In the second stage, the customer enterprises design incentives in four contexts. Stackelberg game sequence is as follows: first, the customer enterprise gives the revenue sharing incentive coefficient, then the service provider decides its service level, the customer enterprise has the bargaining power, it is both the designer of the contract and the Stackelberg game; it has the first decision advantage in the whole game process and will only make the service provider’s revenue equal to the retained gain. The profit function in the model can be expressed as follows, based on the previous hypotheses.

Service provider’s profit function:

Profit function of the customer’s enterprise:

Profit function of service supply chain system:

A.SCENARIO 1: COMPLETE INFORMATION MODEL

When the strategy combination is (provide true information, trust), the customer enterprise can observe the private information of the service provider, and the customer enterprise will design the incentive contract only to satisfy the service provider’s participation constraints. At that time, the customer enterprise’s optimal decision limits the service provider’s decision.

Participation constraint:

In the optimal case, the equation condition for the participation constraint will hold, and the fixed payment received by the service provider is

Bringing equation (5) into equation (2) and taking the first-order partial derivative of yields the optimal service level of the service provider as

Since , it is evident that is independent of . From the target behavior of the enterprise, we know that the customer enterprise will not engage in revenue sharing incentives. At this point, the customer enterprise pays a risk cost of . From the above analysis, we can obtain

B.SCENARIO 2: INCOMPLETE INFORMATION MODEL UNDER SERVICE PROVIDER DISINFORMATION

When the strategy combination is (provide false information, trust), the customer enterprise cannot observe the private information of the service provider. The customer enterprise is in a disadvantageous position, and designing the incentive mechanism needs to consider the maximization of the service provider’s revenue, i.e., max

At this time, the retained earnings of the participation constraint is .

Participation constraint:

The first-order optimality condition of equation (10) yields the optimal service level of the service provider as

From the participation constraint (11) equation, the fixed payment received by the service provider is

Bringing equations (12) and (13) into equation (2) and taking the first- order partial derivative of , the optimal revenue sharing incentive coefficient is obtained as

From the above analysis, we can obtain

C.SCENARIO 3: INCOMPLETE INFORMATION MODEL UNDER CUSTOMER ENTERPRISE DISTRUST

When the strategy combination is (provide true information, no trust), the customer enterprise can observe the private information of the service provider. However, because the customer enterprise’s distrust causes incomplete information symmetry, the customer enterprise expects the retention benefit of the service provider participation constraint to be . Because of min , the retained earnings are when both the service provider’s participation constraint and the customer enterprise’s profit maximization are satisfied.

Participation constraints:

The solution process is the same as Scenario 2; we can get

D.SCENARIO 4: TWO-PARTY INFORMATION ASYMMETRY MODEL

When the strategy combination is (provide false information, do not trust), the customer enterprise cannot observe the private information of the service provider. We know that the customer enterprise expects the retention benefit of the service provider to be , and the retention benefit of the service provider when it “provides false information” is . (1) When , in reality, the customer enterprise expects less retention benefit from the service provider, so this scenario is not explored in this paper. (2) When , the retained earnings are when both the service provider’s participation condition and the customer enterprise’s profit maximization are satisfied.

Participation constraints:

The solution procedure is the same as above, which yields

IV.MODEL COMPARISON

This paper compares the optimal parameters in different contexts as follows.

Conclusion 1: The relationship between the magnitude of the service level of the service provider is . , , and increases with t, the fastest rate of increase under scenario 1. is independent of and decreases as increases.

- (1)Because of , we can obtain .

- (2)Because of , and , we can obtain .

- (3)Because of and , we know that is independent of β and decreases as β increases.

From conclusion 1, we find that the incentive of the customer enterprise to the service level through knowledge participation is always effective, which is because the knowledge of the customer enterprise and the service provider’s service is complimentary. As the knowledge participation increases, the service provider’s familiarity with the project knowledge becomes an incremental trend, which greatly reduces the difficulty of the service and improves the motivation of the service provider. In scenario 1, the service provider has the highest service level because the customer enterprise knows the private information of the service provider, which reduces the moral hazard of the service provider due to the information advantage. Under asymmetric information, higher risk aversion leads to a lower willingness of the customer enterprise to participate. The service level under the complete information scenario is independent of the degree of risk aversion and does not decrease due to the customer enterprise itself.

Conclusion 2: The relationship between the profit of the service supply chain system, the profit of the service provider, and the size of the profit of the customer enterprise are , , and . Respectively. , , , , , , , and increases and then decreases as t increases.

- (1)Because of , we get .

- (2)We already know and , so , , , , and . In summary, we get and .

- (3)Let find the first-order partial derivative for t and make it equal to zero to obtain ; when , we get ; when , we get . Therefore, we can know that increases and then decreases with t. The proof is the same as above, and we can obtain that , , , , , and increase and then decrease with t.

From conclusion 2, we find that the profits of customer enterprises and service supply chain systems are the highest under complete information. In scenarios 2, 3, and 4, the profits of the supply chain system are the same, which is because the benefits generated by service outsourcing in the information asymmetry scenario are fixed, and the size of the profits of the service provider and the customer enterprise depend only on their information advantages. The customer enterprise’s profit and the supply chain system’s profit increases and decreases as the customer company’s participation increases. This is because when the customer enterprise’s participation is too high, the unit benefit is smaller than the unit cost, and it is unfavorable for the customer enterprise to increase knowledge participation at this time. In reality, if the customer enterprise aims at maximizing the profit of the service outsourcing process, it has optimal knowledge engagement. Suppose the customer enterprise aims at higher service performance. In that case, it will deviate from the optimal knowledge engagement degree. The customer enterprise can adjust the knowledge engagement degree to meet its outsourcing service performance according to its needs.

V.DYNAMIC GAME PROCESSES AND COORDINATION MECHANISMS

A.DYNAMIC GAME PROCESSES

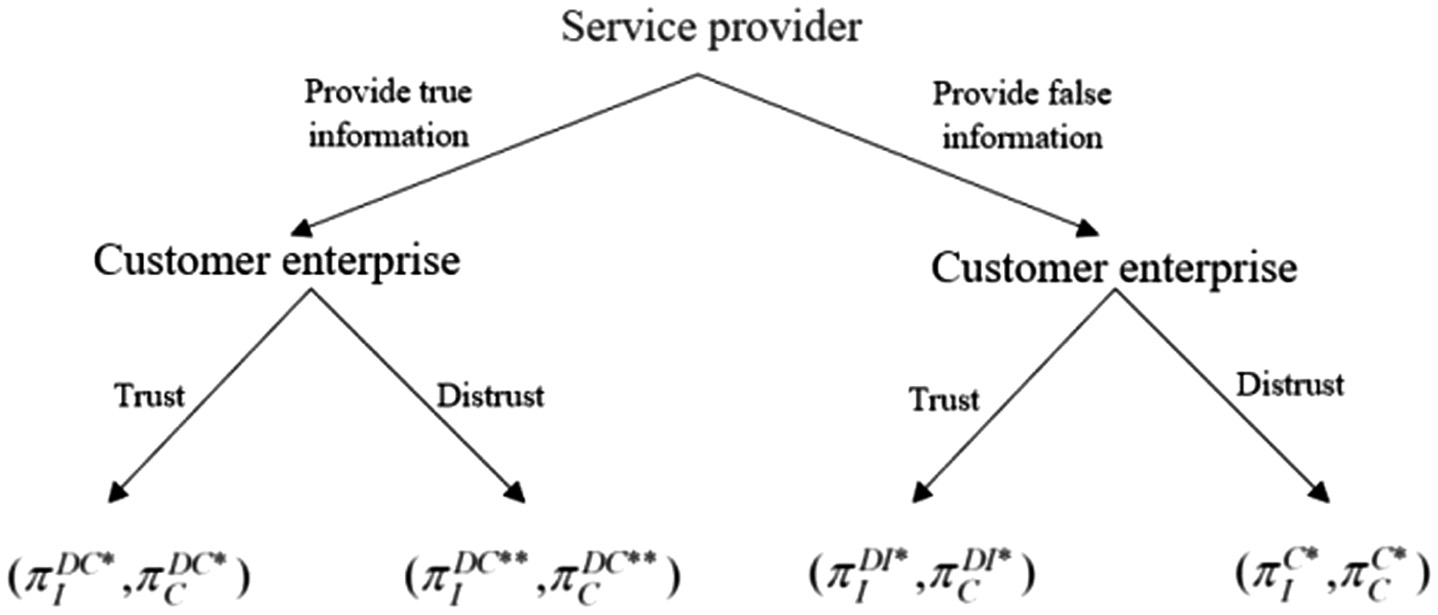

The dynamic game process is as follows (Fig. 1).

Fig. 1. Stackelberg model dynamic game process

Fig. 1. Stackelberg model dynamic game process

Reverse induction yields as the Nash equilibrium of the game. The combined conclusions 1 and 2 show that the Nash equilibrium of the dynamic game is not optimal, and the complete information model under scenario 1 is Pareto optimal when considered from the perspective of the supply chain system. However, with complete information. The service provider has the highest level of service and the lowest revenue, and the service provider, as a “rational person” is not willing to reach this result.

B.COORDINATION MECHANISM UNDER COMPLETE INFORMATION

In order to achieve cooperation among supply chain subjects, it is necessary to ensure that the profits of each party after coordination are more significant than their respective profits at Nash equilibrium. Therefore, the customer enterprise needs to give a portion of the distributable profit to the service provider to make up for the reduced profitability of the service provider under the complete information model. After coordination, the service provider profit is , the customer enterprise profit is , must ensure that and .

Let and . When satisfies equation (31), the coordination mechanism can achieve the coordination of the supply chain system.

VI.DISTRIBUTED INCENTIVES IN THE FRAMEWORK OF BLOCKCHAIN-BASED RISK PREVENTION ARCHITECTURE AND COORDINATION MECHANISM

A.BLOCKCHAIN-BASED RISK PREVENTION ARCHITECTURE

Under the premise of ensuring the coordination mechanism’s effectiveness, allocating distributable profits, preventing service providers’ moral hazard, and improving service providers’ motivation become important research issues, and monitoring and incentives are necessary to address these issues. This paper proposes a blockchain-based regulatory framework for the service outsourcing process to standardize and guide the design of the regulatory mechanism to ensure the transparency of information, survivability of process, and controllability of service level in the service outsourcing process. This addresses the shortcomings of the principal-agent theory in solving these problems. The architecture presents the process of outsourcing services as a blockchain transaction, encompassing supply chain node companies, blockchain smart contracts, and the entire outsourcing transaction.

The architecture is divided into three layers depending on the function, as shown in Fig. 2.

Fig. 2. Blockchain-based regulatory architecture for service outsourcing process.

Fig. 2. Blockchain-based regulatory architecture for service outsourcing process.

The distributed database stores the data generated by the service outsourcing process, and the service provider and the customer enterprise upload the relevant activity information to the system. The customer enterprise and the service provider have complete data, and distributed technology ensures the accuracy of the information. Asymmetric encryption technology ensures that the identity information of nodes need not be disclosed, timestamp technology ensures the uniqueness of transaction order and data, consensus mechanism ensures joint verification of the legitimacy of transaction information, and smart contracts are used to implement the control of service level and service result to improve the efficiency of the service process.

The contract layer helps with data sharing and monitoring the whole outsourcing process. As the process of service data sharing may involve its core knowledge, some information needs to be kept confidential for both parties, digital identity can control the access to data, and smart contracts have real-time service level data and customer enterprise knowledge participation data, which can be monitored in real-time.

The business layer is the various activities of the enterprise in the service outsourcing process, where both the customer enterprise and the service provider can control and manage the service process, service level, and customer engagement level.

B.DISTRIBUTED INCENTIVES IN THE FRAMEWORK OF COORDINATION MECHANISMS

The incentive mechanism directly determines the motivation of service providers. With reference to Wang et al. [21,22], an incentive party mechanism based on the awareness of service outsourcing reputation is proposed to encourage service providers to collaborate in a good way. The success of service outsourcing is not only related to the service provider’s service capability but also includes the service provider’s historical service quality and collaboration capability. The service provider’s incentive compensation is calculated based on two pricing factors: the service quality factor and the service provider’s collaboration factor during the service term.

1)Service Quality Factor

Service quality is evaluating past service providers’ related services and considering current service outsourcing results, which reflects the service provider’s service capability and quality. The historical service parameters of the service provider include service failure rate and service satisfaction, and the current service parameters include outsourcing output .The formula is

where is the number of failed historical services, is the total number of historical services, is the historical service duration, and is the current service duration. r is the historical service record factor, which takes the value (0,1), considering the service records’ validity. The longer the interval, the less the reference value contributed by the previously recorded current service decisions.Let Q be the service quality of the service provider, n, m, and l be the weights of the three-parameter factors, n + m + l = 1. The service quality is inversely proportional to the service failure rate and positively proportional to the service satisfaction and outsourcing output.

2)Collaboration Factors of Service Providers during the Service Term

The service provider’s collaboration A is a measure of the frequency F of transactions and the number B of blocks generated by the service provider during the service period, reflecting the service provider’s engagement and the service provider’s reputation. Suppose the service outsourcing process successfully generates a block and is confirmed by the customer enterprise. In that case, the service provider will be rewarded with a reputation, and the higher the frequency of the service provider’s transactions, the higher its collaborative behavior. The specific formula is

where denotes the number of transactions by the service provider during the service outsourcing period and is the expected maximum number of transactions.Let A be the collaboration factor of the service provider during the service term, and z and x be the weights of the two-parameter factors, z + x = 1.The collaboration ability is proportional to the transaction frequency and the number of generated blocks.

In Fig. 3, we use the service provider’s service quality and the service provider’s collaboration factor during the service term as pricing factors. The service platform pays the corresponding virtual currency according to the pricing.

Fig. 3. Credibility-based incentives.

Fig. 3. Credibility-based incentives.

The pricing of incentive compensation satisfies (37).

where e is the intensity of the outsourcing task; are the weights of the two pricing factors and ; the quality of the service is indicated by these two factors. The higher the quality and reputation, the higher the price, and satisfies .VII.NUMERICAL SIMULATION

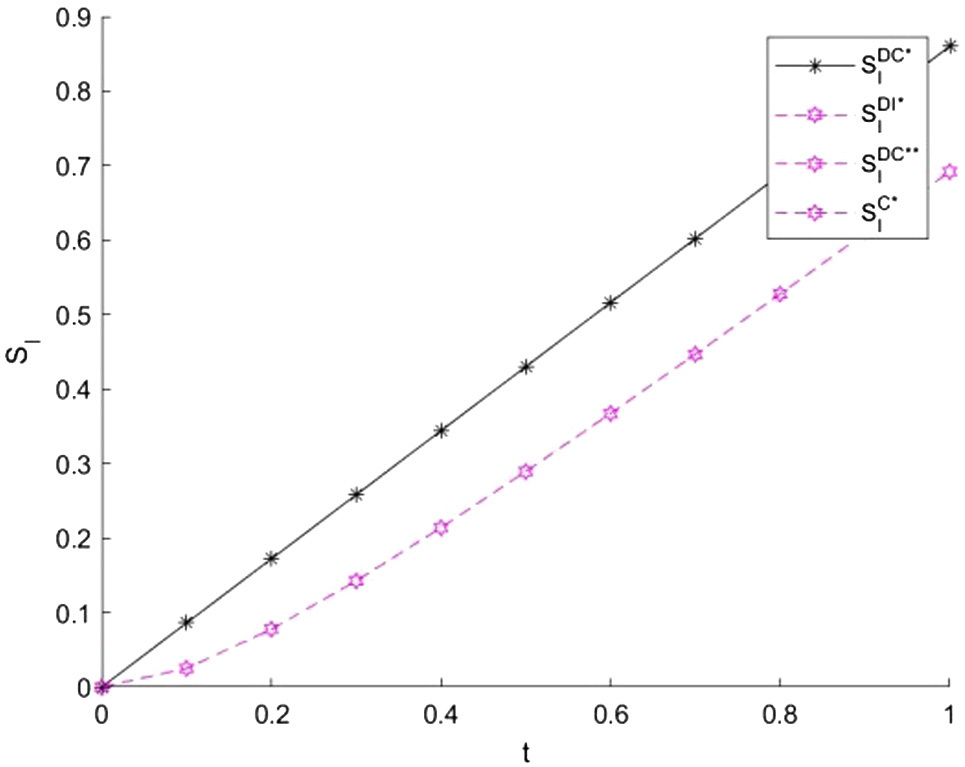

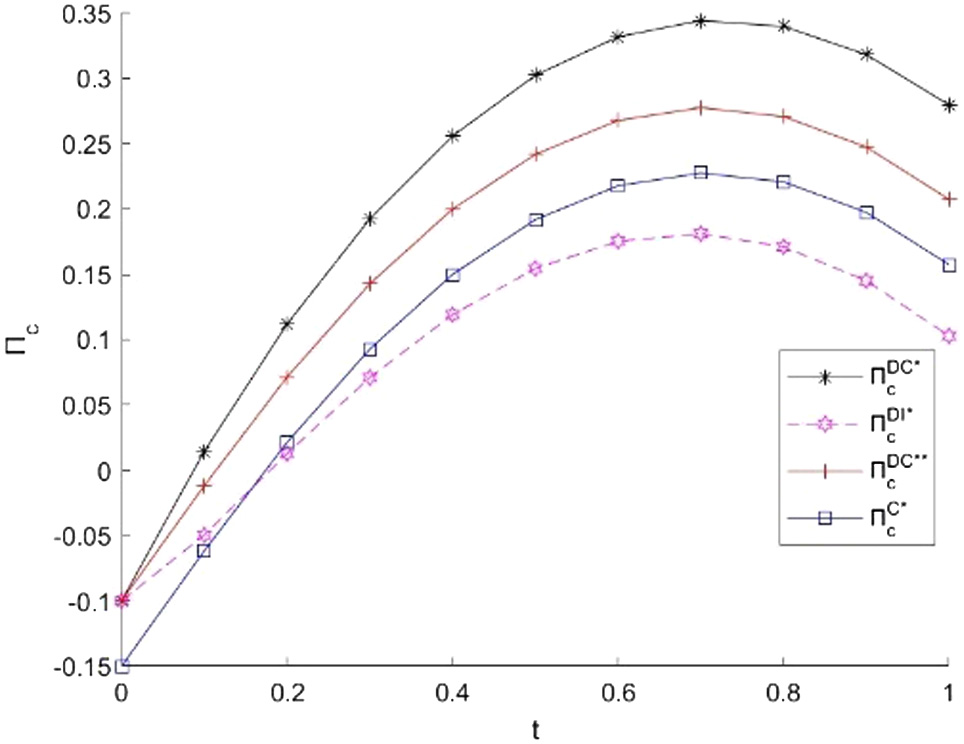

This section demonstrates the effectiveness of the above models through numerical simulations, first comparing the optimal parameters of the four models, analyzing the impact of customer knowledge participation, and then analyzing the effectiveness of the coordination mechanism. Assume that . Taking t as the independent variable, when , the comparison of each decision variable and the sensitivity about t are shown in Figs. 4–7.

Fig. 4. Comparison of service provider service levels and sensitivity analysis.

Fig. 4. Comparison of service provider service levels and sensitivity analysis.

Fig. 5. Comparison and sensitivity analysis of supply chain system profits.

Fig. 5. Comparison and sensitivity analysis of supply chain system profits.

Fig. 6. Comparison and sensitivity analysis of profit of customer enterprises.

Fig. 6. Comparison and sensitivity analysis of profit of customer enterprises.

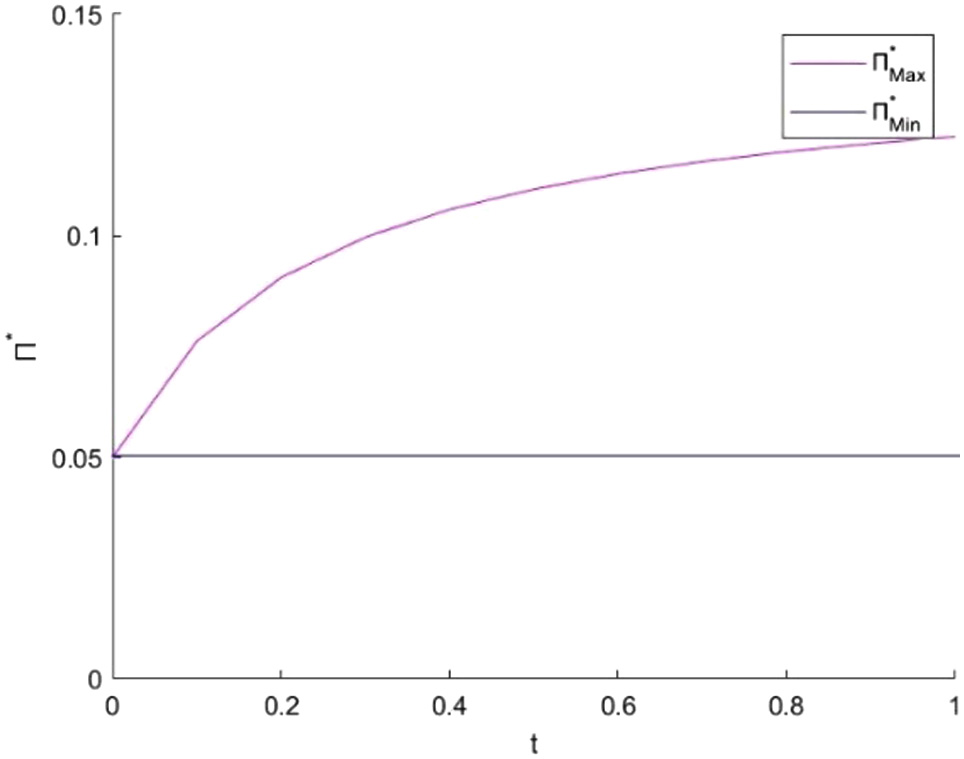

Fig. 7. Interval of distributable profit.

Fig. 7. Interval of distributable profit.

- (1)The service level of the service provider increases with customer enterprise involvement. The service provider has the highest service level and the highest impact effectiveness of customer involvement under the complete information model. This is because, at this time, the customer enterprise knows the private information and actions of the service provider’s decision, which largely reduces the “lazy” behavior of the service provider.

- (2)Under the complete information model, the profit of the customer enterprise and the profit of the supply chain system are maximized because the symmetry of information reduces the moral hazard of the service provider and thus ensures the profit of the customer enterprise itself.

These findings are consistent with conclusions 1 and 2, thus justifying the model study.

It can be seen from Fig. 7 that the range of distributable profits of customer enterprises increases with the increase of knowledge participation of customer enterprises since the difference between profits of customer enterprises under complete information and under incomplete information gradually increases with the increase of knowledge participation of customers. The effectiveness of the coordination mechanism is verified below. According to the values of the above parameters and making t the independent variable, the calculation results in Table I can be obtained after using the coordination mechanism.

Table I. Comparison of coordination results under different knowledge participation

| Customer enterprise knowledge engagement | Distributable profit | Profit comparison after coordination |

|---|---|---|

| t = 0.1 | ||

| t = 0.2 | ||

| t = 0.3 | ||

| t = 0.4 | ||

| t = 0.5 | ||

| t = 0.6 | ||

| t = 0.7 | ||

| t = 0.8 | ||

From the calculation results in Table I, when satisfies , the Pareto improvement of the customer enterprise and the service provider’s revenue can be achieved, prompting the game to reach the complete information scenario, which realizes the “win-win” for the service supply chain members.

VIII.CONCLUSIONS AND RECOMMENDATIONS

A.CONCLUSIONS

In order to study the moral hazard problem and the problem of information asymmetry between the two parties in the service outsourcing process, this paper constructed a Stackelberg game model based on the principal-agent framework. On the basis of this model, we then proposed a blockchain-based regulatory architecture for the service outsourcing process and a blockchain-based distributed incentive mechanism. The results showed that the moral hazard of the service provider did not lead to an increase in its own revenue and a decrease in the profit of the other party, but rather damaged both parties’ interests and reduced the performance of service outsourcing. Moreover, the outcome of the service outsourcing game was the information asymmetry scenario, and the complete information scenario was the Pareto optimal. With the aid of incentives and coordination mechanisms, the customer enterprise could achieve Pareto improvement. Because of the inadequacy of principal-agent theory in solving the problems of information asymmetry and moral risk, the advantages of distributed ledger technology, a consensus mechanism, a timestamp, an asymmetric encryption algorithm, and smart contracts on the blockchain could effectively cope with the moral risk of service providers and solve the problem of bilateral information sharing, which could grasp and track the dynamics and responsibilities of service providers in real-time, reduce the probability of their opportunism, guarantee the performance capability, and further improve the stability of the service outsourcing supply chain.

B.RECOMMENDATIONS

First, cooperation is the greatest way to safeguard everyone’s interests when outsourcing services, and the supply chain model is designed to promote it. From the perspective of the service provider, if the service provider, as the primary bearer of the service process, tries to maximize its interests by using an asymmetric information advantage, it not only harms its interests and those of others but may also result in the failure of the service output to satisfy the requirements of client enterprises or even result in the failure of service outsourcing. Therefore, service providers should provide more real information without disclosing core knowledge, provide a high-quality soft environment for cooperation, and establish a strategic cooperation relationship from the perspective of mutual interests in order to better pursue common development in the service outsourcing cooperation environment and supply chain.

Second, information sharing between two parties in service outsourcing needs to be driven by external forces. Conscious restrictions make it challenging to reach the Pareto optimal aim in a dynamic game. In order to ensure the efficiency of the incentive mechanism, customer firms should submit service agreements and transaction regulations to service providers. In order to create information symmetry during the service outsourcing process, customer enterprises must design incentive mechanisms. This is essential for advancing both parties’ interests and promoting outsourcing performance.

Third, distributed ledger technology, consensus mechanisms, timestamps, asymmetry, and other technologies can offer a better solution to the issue of information asymmetry and moral hazard as disruptive impact frontier technologies. However, the research on blockchain in service outsourcing is still at the preliminary exploration stage. In the future, in-depth research can be conducted in terms of expanding the application of blockchain technology, improving the willingness of stakeholders to use it, and clarifying the application strategy of blockchain to further promote the development and application of blockchain technology in service outsourcing, actively introducing blockchain technology and using its characteristics, such as non-tamper ability and open consensus, to reduce the negative impact of information asymmetry and fully inhibit problems such as moral hazard formed due to information asymmetry.