I.INTRODUCTION

As of 2020, the proportion of people aged 60 years and above in Malaysia comprises more than 10% of the total population (Department of Statistics Malaysia [1]. A projection made by the Department of Statistics Malaysia [2,3] reveals that Malaysia will officially become an aging country when the percentage of the elderlies reach 15% sometime between 2030 and 2035. The aging problem arises as a result of declining mortality rates together with a drop in the fertility rates, which will eventually lead to fewer working-age people in the economy. One important indicator of population aging is the old-age dependency ratio (OADR), which expresses the ratio between the economically inactive to the economically active individuals in the population. Hence, a rapidly aging nation will have a high OADR indicating a greater burden faced by the younger generation in order to support the necessities of the elderlies. This phenomenon has become a serious threat to economic growth, savings, consumption, employment, and pensions, which require further social amendments. Chomik and Piggott [4,5] said that there are two areas of social policy that are particularly relevant to population aging which are retirement income and healthcare. The elderly is both physically and economically vulnerable because old age care might be costly and thus causing them to more likely to face exposure to hazards and emergencies. To cater the necessities during old age due to increase in the lifespan, the elderly is demanded to have a better financial allocation. It is proven that with the help of government healthcare programs, along with the public and private pensions, the income gap between the old and working age has narrowed and the poverty rates among the elderly has also reduced significantly.

Pension is a periodic payment scheme that is typically paid monthly or based on a specified interval, made during retirement from an investment fund to which the individual or their employer contributed during their working life. The Malaysian pension system generally consists of four different categories: a tax-funded defined-benefit (DB) pension scheme (the government pension scheme) for public sector employees, a publicly run defined contribution (DC) retirement scheme for private sector employees, a DC scheme for members of the armed forces, and a privately run contribution plan that is open to everyone [6–8]. The government pension scheme is the only noncontributory, DB scheme that pays a maximum of 60% of the last drew salary to civil service retirees and provides both survivorship and death benefits, as well as subsidized lifetime healthcare. It is presently funded on a pay-as-you-go (PAYG) basis, with current taxes contributing to current retirees. The Malaysian government pension scheme was inherited from Great Britain as a result from past colonialism. The Pension Trust Fund was set up in 1991 in order to lessen the burden on public finances. It is later assimilated as the Retirement Fund (Incorporated) or Kumpulan Wang Amanah Pencen in 2007, which is responsible in managing and financing the public pension scheme. This is in contrast to the DC scheme in Malaysia such as the EPF where the benefits are determined based on the contribution level and return on the fund’s assets. The retirement benefits in a DB scheme, on the other hand, depend on the employee’s final salary and length of pensionable service. In addition, the investment risk in a DB scheme is borne by the employer whereas in a DC scheme, the investment risk is borne by the employees. Hence, the government as the employer of public sector employees must ensure that there is sufficient money in the pension fund in order to make future pension pay-outs to the retirees. The difference between the total amount due to retirees and the actual amount of money that is available in the fund is what created the liabilities. From an actuary point of view, pension liability is defined as the present value of benefits to be paid to current and retired employees. Liabilities will only occur in a DB pension scheme and if the liabilities exceed the assets in the retirement plan, it will result in an underfunded pension plan. With the current rapid aging phenomenon where mortality rates are expected to keep declining over time and therefore increasing the proportion of elderly in the population, it is worrying that the DB scheme is not going to sustain.

According to Hikmah [9], the actuarial liabilities of the participants grow for each period as the working time increases. It appears that the increasing age of the participant will lead the participant actuarial liabilities that must be owned by the pension fund to be increased. Wahab et al. [10] stated that the government pension expenditures and general provident funds (a proxy to pension liabilities) are significantly affected by the increasing of OADR and the average life expectancy in both long-run and short-run period.

However, with the current PAYG pension system in Malaysia, it is concerning that the government pension scheme will result in unfunded liabilities when pension benefits paid out are growing at a much faster rate than the revenue as a consequence of shrinking labor force and expanding old-age group, and they are becoming a larger part of government spending. Darmaraj and Narayanan [11] mentioned that in Malaysia, the increasing number of public sector employees, longer life expectancy, and the expanding benefits under the Civil Service Pension Scheme (CSPS) trigger the escalating government spending on pensions. To our knowledge, there are a limited number of published articles using the six-point Lagrangian interpolation method to interpolate the mortality rate. Most of the papers used Heligman–Pollard method, which requires more complicated and tedious computation. Therefore, this study aims to provide literature on this particular method, which is considerably accurate given the low percentage of error. Other than that, there are also a restricted number of literatures that discusses the sensitivity analysis on pension liabilities in Malaysia; while it was held known that the current pension system is financially unsustainable. In view of this, the study is proposed to analyze the mortality trend in Malaysia by considering the mortality data for the past 20 years for both males and females. Then, further investigation into its significance on the government pension system, specifically on the pension liabilities, will be observed through the sensitivity analysis.

The rest of the paper is organized as follow. Section II presents related studies, while Section III discusses the method and sensitivity analysis of the study. The results and discussion are mentioned in Section IV, whereas Section V provides conclusion of the study followed by acknowledgment and references.

II.LITERATURE REVIEW

There are several studies that observed the aging rate in Malaysia. Ibrahim et al. [12] analyzed the central deaths rates and approximated the Malaysian elderly’s life expectancies using the life table approach. Moreover, the study also attempted to estimate the life expectancy improvement to observe the aging rate in Malaysia. The result showed that Malaysian elderly mortality rates for both males and females increase in an almost a linear trend consistently from 1950 to 2015. Additionally, they also found that the mortality rate among elderly females is lower than elderly males. They also discovered that elderly males aged 85 years and above in 2010–2015 live longer by about 123% than those in 1950–1955. In addition, a study by Kamaruddin and Ismail [13] was conducted where they used Malaysia deaths records for a period of 29 years from the year 1984–2012 by utilizing the original Lee–Carter model. From the presented data, the forecasted log mortality rates for the next 10 years are then obtained. The result demonstrated that for all three age groups, which are children, young adults, and the elderly, although there were a few fluctuations within the period of time, the overall trends tend to show a downward trend until the year 2022. Hence, these downward trends in mortality rates signify the aging population in Malaysia. Bielecki et al. [14,15] notifies that when there is a decline in mortality rates in pension members, it will affect the pension scheme. This is due to the circumstances where when the mortality rate decreases, pensioners are likely to have longer lives. This leads to an increment in benefit paid to the member, while the contributions stay the same.

Furthermore, Wang et al. [16] said that the uncertainty in demography would significantly affect long-term benefits. They also concluded that in the future, thorough and comprehensive researches on the effect of change in mortality trends on the sustainability of pension system are required. A study of mortality trends by specific ethnic and age groups in the year 1970 until 2010 was carried out by Ibrahim and Siri [17]. Since the data is available in 5-year age groups only, such as 5–9, 10–14, and 15–20, the distribution or interpolation method was required in order to interpolate it to the individual ages. The Heligman–Pollard model is used to estimate the age-specific mortality rates in Malaysia for a period of 40 years using MATLAB 7.0. The study revealed that there is a continuous downward trend in the overall mortality rates in Malaysia population for the 40-year period of time with males having a higher mortality rate compared to females. The decreasing pattern in elderly mortality rates indicates that there will be an increasing proportion of the elderly in the population.

Apart from that, Bujang et al. [18] investigated the trend of national mortality rates in a period of 16 years, from the year 1995–2010. In the study, a comparison by specific age groups, infants (1 year and below), under 5, adolescents, adults, middle age and elderly, and gender has been done. Mortality rates are calculated by dividing the number of deaths by the population estimates obtained from the Department of Statistics Malaysia, which then is plotted against year. However, for infants and under 5, the mortality rates are computed by using live birth statistics as the denominator rather than population estimates. The result showed that there is an upward trend in infant and under 5 mortality rates, and the opposite for the other four age cohorts including the elderly group where a declining pattern in mortality rates is observed. Concern arises in the pattern exhibited in the elderly group, as related policies are needed in order to support and sustain senior citizens in an era of aging population.

From an actuarial point of view, pension liability is defined as the present value of benefits to be paid to current and retired employees. The difference between the total amount due to retirees and the actual amount of money that is available in the fund is what created the liabilities. Liabilities will only occur in a DB pension scheme and if the liabilities exceed the assets in the retirement plan, it will result in an underfunded pension plan. With the current rapid aging phenomenon where mortality rates are expected to keep declining over time and therefore increasing the proportion of elderly in the population, it is worrying that the DB scheme is not going to sustain. Gee San [19] found that all of their DB plans are underfunded, and that the public employee pension plan alone has resulted in a total debt of over 9 trillion. Although the Taiwanese government has made several reformations in the DB plans including cutting the retirement benefits, increasing contribution rates, and extending the retirement age to 65 years, the strict reformations can only extend the sustainability of the pension plans for a short period of time. Given the worsening aging problem in Taiwan, immediate actions must be taken to handle the financial crisis and to avoid further intergenerational conflict. He stated that the supremacy of the DB plans is influenced by the ability of the government to compensate for the funding gaps of pension plans and guarantee the payment of retirement benefits to public employees. Therefore, several changes must be implemented to ensure the pension system’s sustainability. The worker-to-retiree ratio, for example, can be improved by raising the retirement age or modifying employment and immigration regulations.

In addition, Chen and Matkin [20] found that the mortality improvement rate for the older age group (40 and 65 years) becomes larger which will lead to higher marginal effect. This shows that mortality changes will affect the pension system in the future. Munnell et al. [21] examined the effect of longer lifespans on state and local pension funding. They are interested in knowing whether outdated mortality assumptions are a critical issue among state and local plans in the United States. The result indicated that an additional year of life expectancy would increase the pension liabilities by 3.5%. They concluded that the outdated mortality assumptions are not yet a serious problem among state and local plans. Additionally, Dushi et al. [22] carried out a study to investigate the impact of aggregate mortality risk on DB pension plans in the United States. The two elements of aggregate mortality risk are the risk that the DB plan providers may be using a biased estimate of participant mortality, and the risk that the calculations on unbiased forecasts of mortality is incorrect. For the first part, by using the two commonly used mortality tables, GAM83 and RP2000, the authors identified that usage of either mortality table without projecting mortality would understate the liabilities borne by the pension providers. Given the range of forecasts implicit in the Social Security Administration and Lee–Carter projections, the probability of understating male mortality rate is between 6.7% and 15.2%. Female mortality rate on the other hand is expected to have lower understatement possibilities, which range from 1.1 to 4.5% due to their insignificance mortality improvement. In the second part, by assuming that the mortality rates follow the projections of the Lee–Carter model and then running the Monte Carlo simulations, they discovered that for a continuing plan’s projected benefit obligation, there is a 5% annual probability that it would increase by 1.07% or more and 1% probability that it would increase by 1.41% or more. They found that an aggregate mortality improvement would cause an increase in pension liabilities.

III.METHOD

A.SIX-POINT LAGRANGIAN INTERPOLATION

In order to analyze the Malaysian population mortality trends, this study requires the Abridged Life Table for the year 2001 until 2020. However, since the data in the Abridged Life Table is only available in a 5-year range and time intervals such as 5–9, 10–14, 15–19, 20–24, and so forth, interpolation needs to be done in order to obtain the mortality rate for each individual age. Six-point Lagrangian is an acceptable method to interpolate over the age range 1–74 years. For this method, interpolation will be done on the number of lives at age x, lx instead of the probability of a person age x dying before age x+n, nqx. The formula of six-point Lagrange interpolation is given as follows:

and the coefficient is calculated by using the formula as follows:Then the probability of a person age x to survive until age x + 1, px and the mortality rate, qx can be computed by using formulas described in Table I.

Table I. Life table notations and formulas

| Notation | Definition | Formula |

|---|---|---|

| px | Probability of a person age x survives until age x+1 | |

| qx | Probability of a person age x dies between age x and x+1 | |

| npx | Probability of a person age x survives until age x+n | |

| nqx | Probability of a person age x dies between age x and x+ n |

B.PROJECTED UNIT CREDIT (PUC) METHOD

In this study, the assumption of participants’ salary at age x is taken from the median salary at age x, while the percentage increase in salary S is assumed to be 6 percent, taking the average in salary increment from 2005 to 2019. During this period, the increments vary from 4.4 percent to 8.4 percent [23]. The retirement benefits at age r can be expressed as follows:

Given the assumption of last salary as:

Therefore, the retirement benefits at age r can be written as follows:

The benefits of retirement for individual age x can be expressed as follows:

where r = standard retirement age;x = age at the time of valuation;

e = entry age of the participants;

k = rate of retirement benefits;

= participant′s salary at age x; and

s = percentage of salary increment.

Then, for individual age x who began working at age e, the pension liability formula can be written as follows:

where and are the commutation functions, and = the present value of 1 payable monthly at the beginning of each year to a life aged x and is calculated by using the formula as follows:In this study, we shall consider only two commutation functions for single life which are defined as:

For this study, it is assumed that the retirement benefit is 2% of the final salary for each year of service and the entry age is 25 years. Therefore, the pension liability formula can be written as follows:

Next, in order to observe the changes in pension liability when relevant variables change, a sensitivity analysis will be conducted at four different ages at time of valuation, which are 40, 45, 50, and 55. There will be five different scenarios with different variable changes. This will be discussed in detail in the next section.

C.SENSITIVITY ANALYSIS

By using the projected unit credit (PUC) method, pension liabilities will be calculated for five different scenarios with four different ages at time of valuation which are 40, 45, 50, and 55 years. Summary of sensitivity analysis for the study is presented in Table II, and the details of five scenarios are described below the table.

Table II. Sensitivity analysis summary

| Variable | |||

|---|---|---|---|

| Value | Retirement age | Mortality rate | Age at the time of valuation, x |

| Baseline value | 60 | Mortality rates in year 2020 | 40, 45, 50, and 55 |

| Modified value | 62 and 65 | Reduced by 3% and 5% | |

Scenario 1 (baseline): Age at retirement of 60 years, Malaysian population mortality rates in year 2020, salary growth rate of 6%, and interest rate at 5% will be employed in this study.

Scenario 2: Age at retirement raised to 62 years, 3% reduction in the mortality rates, salary growth rate, and interest rate fixed at 6% and 5%.

Scenario 3: Age at retirement raised to 65 years, 3% reduction in the mortality rates, salary growth rate, and interest rate fixed at 6% and 5%.

Scenario 4: Age at retirement raised to 62 years, 5% reduction in the mortality rates, salary growth rate, and interest rate fixed at 6% and 5%.

Scenario 5: Age at retirement raised to 65 years, 5% reduction in the mortality rates, salary growth rate, and interest rate fixed at 6% and 5%.

IV.RESULT AND DISCUSSION

A.MALAYSIAN MORTALITY TRENDS FOR MALES AND FEMALES FROM YEAR 2001 to 2020

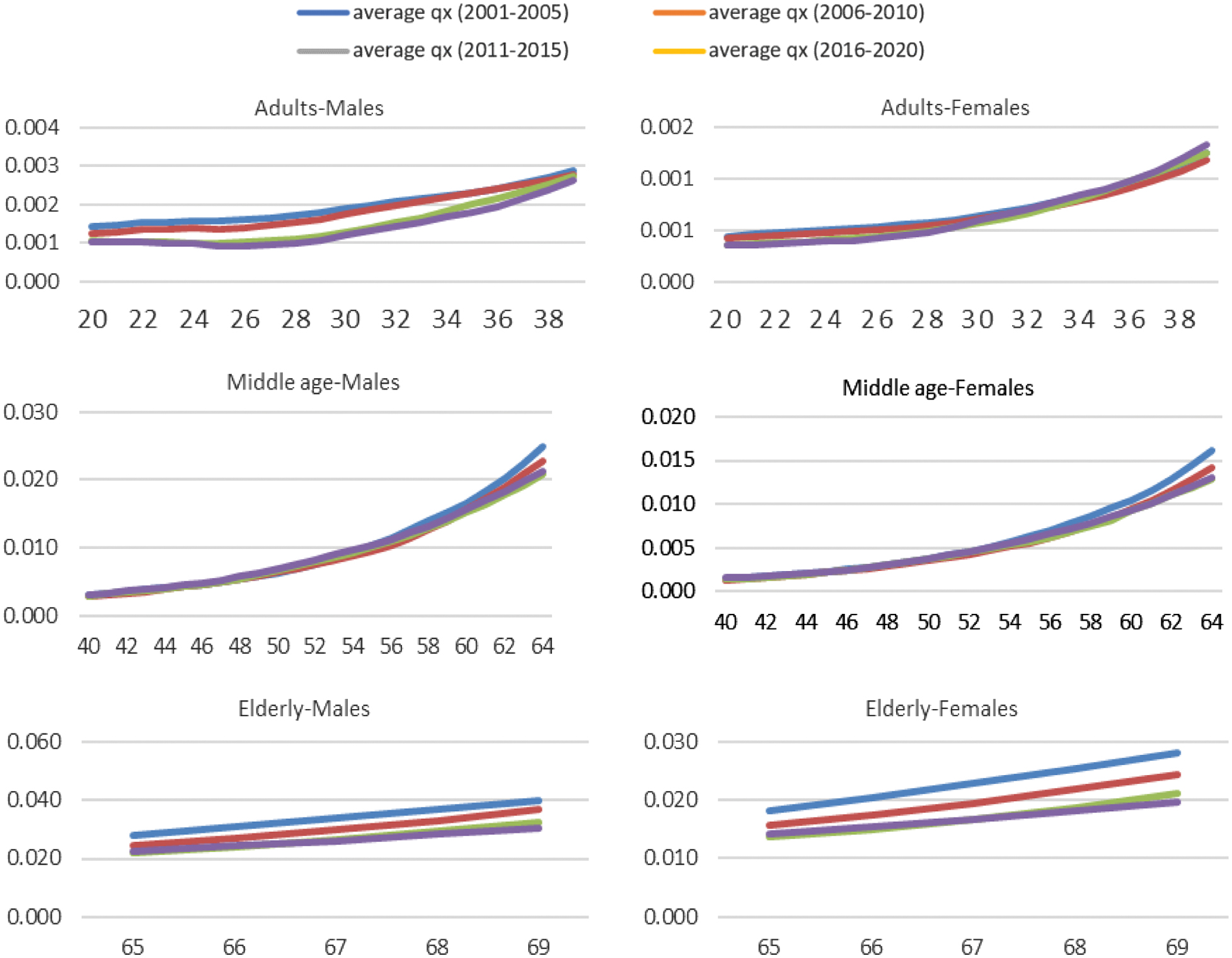

As shown in Fig. 1, we compare the 5-year averages of mortality rates from the year 2001 to 2020. It was discovered that there is a noticeable difference in the pattern of mortality rates of males and females in the adult’s age group. For males, there is a significant improvement in mortality especially at the age 22 years until 34 years. In contrast, females in the same age group displayed only a slight reduction in mortality rates and that is only up until age 32 years. Starting from the age of 33 years onward, the average for adults’ female mortality rates from 2016 to 2020 exceeded the previously recorded mortality rates. Additionally, it was found that females in the adult age group recorded an average percentage change of 0.03 percent throughout the period of the study.

Fig. 1. Five-year average of mortality rates of males and females groups in Malaysia.

Fig. 1. Five-year average of mortality rates of males and females groups in Malaysia.

However, when a comparison is made across genders, it was found that although males showed a remarkable improvement in mortality compared to females, the mortality rates of males are still higher than females. Apart from that, the overlapping in the line plots for both males and females in the early middle age groups indicates that there is no remarkable improvement in mortality rates for these ages. However, starting from the age of 54 to 56 years, when the individuals are approaching the elderly group’s ages, the plot starts to split up and the trend started to imitate that in the elderly group. Besides that, comparison across genders produced the same result as what has been observed in the adult age group where males recorded higher mortality rates than females. There is also a significant mortality improvement recorded in the elderly age group for males and females. Additionally, comparison across genders displayed consistent result as what has been discovered in the previous age groups where males recorded higher mortality rates than females.

This result shows that in general, there is an overall decreasing pattern in the Malaysian mortality rates for both males and females due to the aging phenomenon. In addition, males on average recorded higher mortality rates than females for all age groups. In addition, Tong et al. [24] stated that Malaysian men are lacking in health knowledge and they concluded that the male-unfriendly healthcare system has contributed to the significant difference in mortality rates between males and females in Malaysia. Therefore, the discrimination in the Malaysian healthcare system must be addressed and the importance of early detection to prevent more serious health problems must be actively promoted.

B.RESULTS OF SENSITIVITY ANALYSIS

As displayed in Table III, for individuals aged 40 years, when the mortality rate is decreased by 3% and age at retirement raised to 62 years, the pension liabilities will be reduced by around 15.05% for males and 14.50% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 62 years, the pension liabilities decreased by 14.59% and 14.23% for males and females accordingly.

Table III. Summary of the percentage decrement in pension liabilities for individual age of 40 years

| Males | Females | |||

|---|---|---|---|---|

| r = 62 | r = 65 | r = 62 | r = 65 | |

| reduced 3% | 15.05 | 41.56 | 14.50 | 40.28 |

| reduced 5% | 14.59 | 41.19 | 14.23 | 40.06 |

In addition, by decreasing the mortality rate by 3% and raising the age at retirement to 65 years, it reduces the pension liabilities by 41.56% for males and 40.28% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 65 years, the pension liabilities decreased by 41.19% and 40.06% for males and females accordingly.

Table IV shows that for individuals at age 45 years, if mortality rate is decreased by 3% and age at retirement raised to 62 years, the pension liabilities will be reduced by around 15.09% for males and 14.52% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 62 years, the pension liabilities decreased by 14.66% and 14.27% for males and females accordingly.

Table IV. Summary of the percentage decrement in pension liabilities for individual age of 45 years

| Males | Females | |||

|---|---|---|---|---|

| r = 62 | r = 65 | r = 62 | r = 65 | |

| reduced 3% | 15.09 | 41.59 | 14.52 | 40.30 |

| reduced 5% | 14.66 | 41.25 | 14.27 | 40.09 |

In addition, by decreasing the mortality rate by 3% and raising the age at retirement to 65 years, it reduces the pension liabilities by 41.59% for males 40.30% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 65 years, the pension liabilities decreased by 41.25% and 40.09% for males and females accordingly.

As shown in Table V, for individuals aged 50 years, if mortality rate is decreased by 3% and age at retirement raised to 62 years, it will reduce the pension liabilities by around 15.16% for males and 14.56% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 62 years, the pension liabilities decreased by 14.78% and 14.33% for males and females accordingly.

Table V. Summary of the percentage decrement in pension liabilities for individual age of 50 years

| Males | Females | |||

|---|---|---|---|---|

| r = 62 | r = 65 | r = 62 | r = 65 | |

| reduced 3% | 15.16 | 41.64 | 14.56 | 40.32 |

| reduced 5% | 14.78 | 41.33 | 14.33 | 40.13 |

In addition, by decreasing the mortality rate by 3% and raising the age at retirement to 65 years, it reduces the pension liabilities by 41.64% for males and 40.32% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 65 years, the pension liabilities decreased by 41.33% and 40.13% for males and females accordingly.

Table VI shows that for individuals aged 55 years, if the mortality rate is decreased by 3% and age at retirement raised to 62 years, it will reduce the pension liabilities by around 15.27% for males and 14.62% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 62 years, the pension liabilities decreased by 14.96% and 14.43% for males and females accordingly.

Table VI. Summary of the percentage decrement in pension liabilities for individual age of 55 years

| Males | Females | |||

|---|---|---|---|---|

| r = 62 | r = 65 | r = 62 | r = 65 | |

| reduced 3% | 15.27 | 41.72 | 14.62 | 40.37 |

| reduced 5% | 14.96 | 41.46 | 14.43 | 40.21 |

In addition, by decreasing the mortality rate by 3% and raising the age at retirement to 65 years, it reduces the pension liabilities by 41.72% for males and 40.37% for females. Alternatively, when the mortality rate is decreased by 5% and age at retirement raised to 65 years, the pension liabilities decreased by 41.46% and 40.21% for males and females accordingly.

Based on the result of the sensitivity analysis, raising the retirement age managed to reduce the pension liabilities borne by the government significantly. The effect is slightly more significant among males compared to females as males recorded a higher percentage reduction in pension liabilities in all scenarios. However, it was also found that after the adjustment of the retirement age, if the mortality rate is reduced, it will only cause a minimal change in pension liabilities. This indicates the importance of taking necessary action and long-term mitigations in ensuring the financial sustainability of the public pension fund, even though mortality rates are assumed to be constantly decreasing in the future.

V.CONCLUSION

This study aimed to analyze the Malaysian mortality trends for the past 20 years and to investigate its impact on the government pension scheme. It focused on analyzing the mortality of those in the working age, thus explaining why the analysis for the adolescent was excluded. In particular, it examined the impact of reduced mortality rates as a result of aging population and increased retirement age concurrently on the pension liabilities. It also analyzed the differences in the reduction in pension liabilities when a different increment in the retirement age variable was used. Based on the empirical results, it was found that the six-point Lagrangian interpolation method shows a satisfactory outcome as the error recorded is below 1 percent. On the other hand, the analysis of Malaysian mortality trends indicates an overall decreasing pattern across the ages 20–70 years with females recording a higher mortality improvement compared to males, especially in the older ages. On the other hand, the sensitivity analysis conducted on five different scenarios demonstrated that mortality improvement can adversely affect the pension liabilities. Nonetheless, this can be compensated by increasing the retirement age as what has been done in many other countries such as Australia, Japan, and Singapore. Other measures that can be taken to strengthen the financial sustainability of the pension fund include reducing the replacement rate and introducing the contribution rate in the public pension system [25].